When it comes to Business Activity Statements (BAS), even the most seasoned small business owners and sole traders can get a little overwhelmed. Lodging your BAS is one of those essential tasks that can’t be ignored—but that doesn’t mean you have to face it alone. Whether you’re running a small café, a freelance business, or managing a growing startup, knowing your BAS due dates and working with a tax agent can save you time, money, and a lot of headaches.

What is BAS and Why Should You Care?

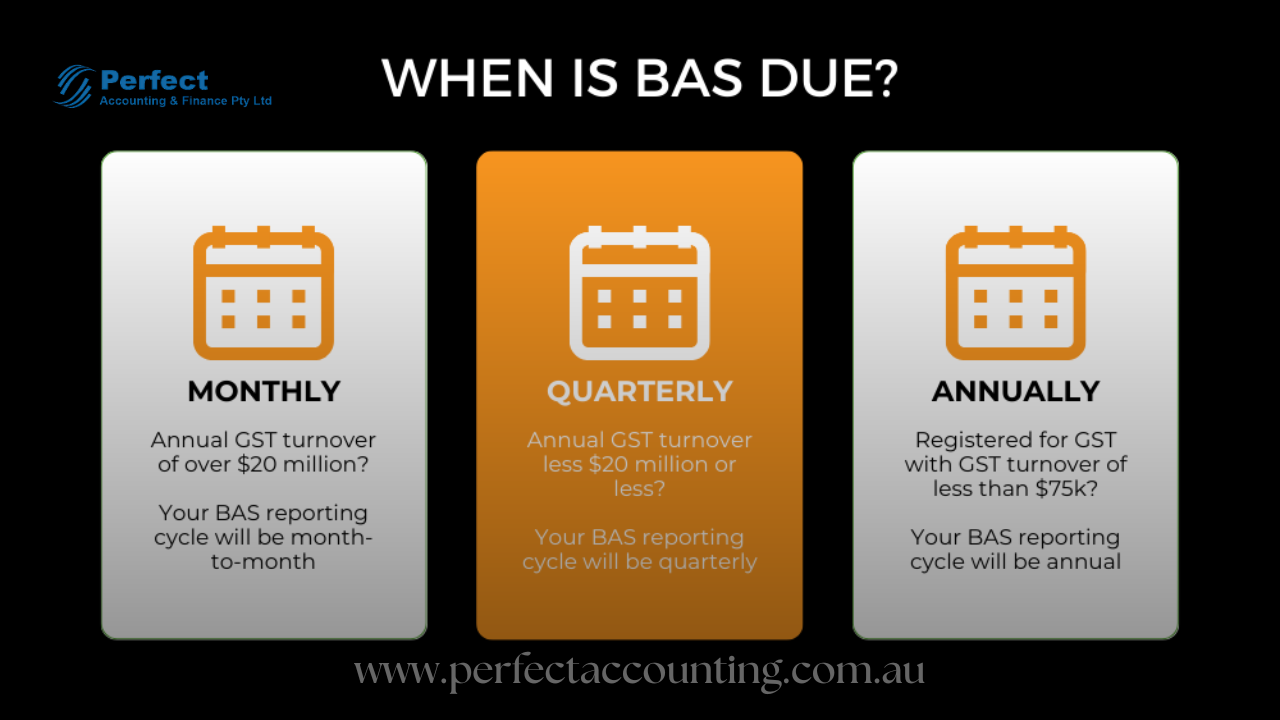

Let’s break it down. A Business Activity Statement (BAS) is a form submitted to the Australian Taxation Office (ATO) to report and pay for goods and services tax (GST), pay-as-you-go (PAYG) instalments, PAYG withholding tax, and other tax obligations. You’ll typically need to lodge BAS monthly, quarterly, or annually depending on your business size.

Learn more about BAS on the official ATO website

Let’s face it—handling tax obligations is not why most people get into business. This is where having a trusted tax agent can be a game-changer.

Why Do BAS Due Dates Matter So Much?

Missing a BAS due date isn’t just a small oversight—it can lead to penalties, interest charges, and even audits from the ATO. But here’s the silver lining: when you lodge through a registered tax agent, you often get extra time to lodge and pay.

Imagine this: Sarah, who runs a small online boutique, was constantly overwhelmed by the quarterly BAS deadlines. She missed one in July, ended up paying a $210 fine, and spent hours sorting out her accounts. After she signed up with Perfect Accounting PTY Ltd, not only did she never miss a due date again, but her tax agent also found deductions she hadn’t claimed before.

The Standard BAS Due Dates (and Extensions with a Tax Agent)

Here’s a simple breakdown of standard BAS due dates if you lodge yourself:

| Quarter | Period Covered | Due Date (if self-lodging) |

|---|---|---|

| Q1 | 1 July – 30 Sept | 28 October |

| Q2 | 1 Oct – 31 Dec | 28 February |

| Q3 | 1 Jan – 31 Mar | 28 April |

| Q4 | 1 Apr – 30 Jun | 28 July |

But here’s the good news: if you use a registered tax agent like Perfect Accounting PTY Ltd, you can get extended deadlines for most quarters—up to four additional weeks in some cases!

See the full ATO extension list for tax agents

Step-by-Step: How a Tax Agent Helps With BAS

Let’s walk through how working with a BAS tax agent makes life easier:

1. Record Keeping

First, gather all your invoices, receipts, bank statements, and payroll info. If that already sounds painful—don’t worry. Tax agents often use accounting software like Xero or MYOB to help you streamline the process.

2. Reconciliation

Your tax agent will match your sales, purchases, and other financial data to make sure everything adds up.

3. GST Calculation

They will ensure that you are correctly calculating GST collected and GST paid, so you don’t overpay—or worse, underpay.

4. Lodgement

The agent then prepares and lodges your BAS directly with the ATO—on time, every time.

5. Ongoing Support

Need to amend a BAS or negotiate a payment plan? A good tax agent will assist with that too.

Why Choose Perfect Accounting PTY Ltd?

If you’re looking for a tax agent who does more than just crunch numbers, you’re in the right place. Perfect Accounting PTY Ltd is known for:

✅ Expert knowledge of BAS due dates and lodgment strategies

✅ Personalised service for small businesses, freelancers, and startups

✅ Ongoing tax planning and business advisory support

✅ Friendly, jargon-free communication

✅ Affordable, transparent pricing

They’re not just about compliance—they’re about confidence. When you work with a trusted agent like Perfect Accounting, you’re not just lodging a form. You’re setting your business up for success.

A Real-World Example

Let’s talk about Josh, a tradie from Melbourne. For years, he’d throw receipts into a shoebox and scramble at the last minute each quarter. After a few late BAS submissions and a nasty ATO reminder letter, he turned to Perfect Accounting PTY Ltd.

Now? His books are up-to-date, he’s claiming everything he’s entitled to, and the stress is gone. He even got a $2,500 refund on his BAS one quarter thanks to smarter GST management. Josh says, “I wish I’d done this years ago.”

Common Mistakes to Avoid

Here are some common BAS pitfalls:

-

Missing BAS due dates

-

Forgetting to include GST-free sales

-

Incorrectly claiming GST credits on personal expenses

-

Failing to reconcile accounts monthly

-

Not using a tax agent when things get complicated

Avoid these traps by teaming up with professionals who deal with BAS every day.

Quick Tips to Stay Ahead

-

Use accounting software – It’ll make BAS lodgement a breeze.

-

Set reminders for due dates – Or better yet, let your agent do that.

-

Hire a registered BAS or tax agent – Especially if you’re running a growing business.

-

Don’t DIY if you’re unsure – Errors can be costly.

Ready to Make BAS Lodgement Stress-Free?

It’s time to stop letting BAS deadlines stress you out. Let the team at Perfect Accounting PTY Ltd take the burden off your shoulders. With the expertise, friendly service, and extra time you get when you lodge through a tax agent, there’s really no reason to go it alone.

Visit www.perfectaccounting.com.au to get started today. Whether you’re a startup, freelancer, or seasoned business owner, they’ll help you stay compliant, save money, and sleep better at night.

Final Thoughts

BAS due dates don’t have to be a source of anxiety. With the right support, the process becomes not only manageable but also a strategic opportunity to better understand your business finances.

So, take the smart step. Partner with Perfect Accounting PTY Ltd, and never worry about your BAS again.