If you’re a small business owner in Australia, you’ve probably heard the term BAS due dates more times than you can count. But what do they really mean? And more importantly, how do you keep on top of them without stressing out every quarter?

Let us walk you through everything you need to know about Business Activity Statement (BAS) due dates in everyday language. No jargon. No complex finance talk. Just simple steps to help you understand and stay compliant. And yes — we’ll even share some real-life stories to make it all more relatable.

What is a BAS, Anyway?

The Business Activity Statement (BAS) is a form submitted to the Australian Taxation Office (ATO) that helps businesses report and pay a number of tax obligations, including:

- Goods and Services Tax (GST)

- Pay As You Go (PAYG) withholding

- PAYG instalments

- Fringe Benefits Tax (FBT)

So essentially, it’s your way of telling the government, “Here’s what I earned and here’s what I owe.”

Why Are BAS Due Dates Important?

Missing a BAS due date can result in late fees, penalties, or worse — an audit. And let’s be honest, no one wants to go through that. But more than that, staying on top of these deadlines helps you manage your cash flow better, avoid last-minute stress, and feel more in control of your business.

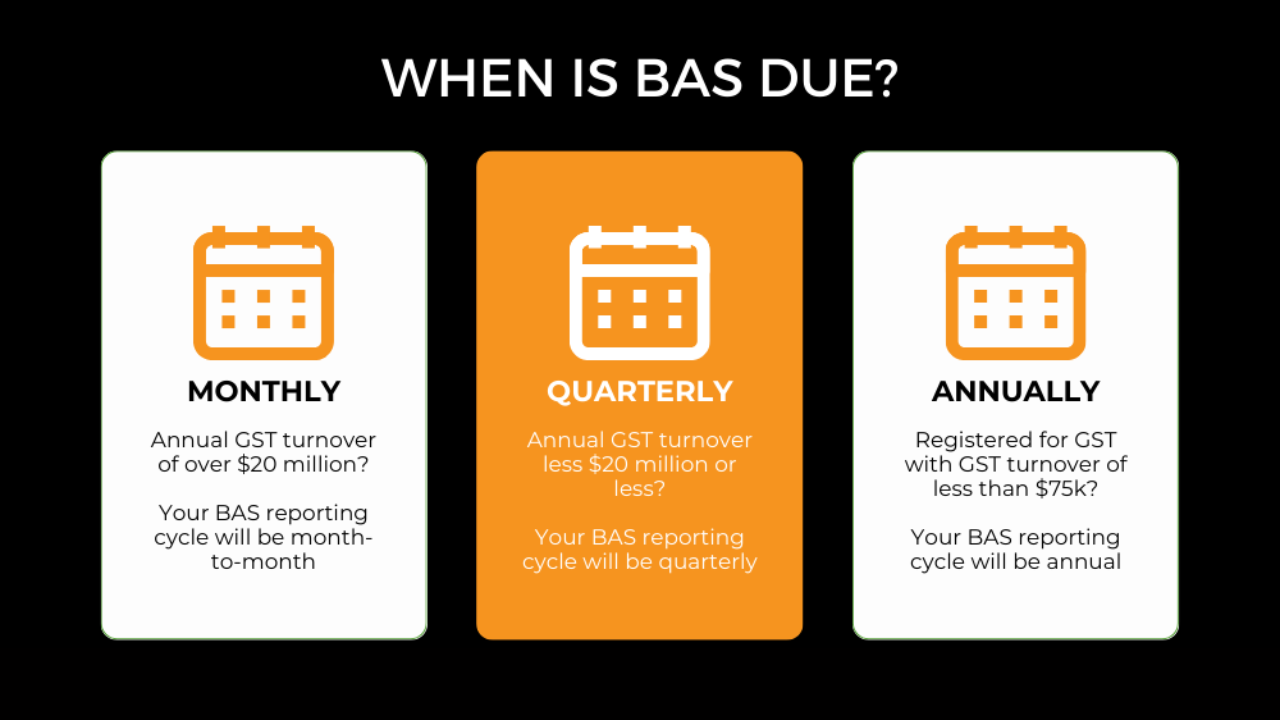

How Often Do You Lodge a BAS?

This depends on your business size and ATO’s requirements:

- Monthly – if your GST turnover is over $20 million

- Quarterly – most small-to-medium businesses lodge quarterly

- Annually – if you’re voluntarily registered for GST and have a turnover under $75,000 ($150,000 for non-profits)

The Standard BAS Due Dates

Let’s break it down into a handy table:

| Quarter | Period Covered | Due Date |

|---|---|---|

| Q1 | July – September | 28 October |

| Q2 | October – December | 28 February |

| Q3 | January – March | 28 April |

| Q4 | April – June | 28 July |

If you lodge through a registered tax or BAS agent, like Perfect Accounting, you usually get a 4-week extension.

Real Talk: A Small Business Owner’s Story

Meet Sarah. She runs a small café in Melbourne. In her first year of business, she forgot to submit her Q2 BAS on time. Not only did she get slapped with a $210 late fee, but she also spent an entire weekend trying to pull receipts together for the next one.

“I thought I could manage it myself,” she says. “But I didn’t realise how much time it would take.”

Eventually, Sarah reached out to Perfect Accounting. Now, her BAS is submitted on time, every time — and she can focus on her coffee art instead of tax forms.

Step-by-Step Guide to Meeting Your BAS Due Dates

Step 1: Set Calendar Reminders

Use Google Calendar or any planner to mark the key BAS due dates in advance.

Step 2: Keep Good Records

Use a cloud-based accounting software like Xero or MYOB to track income, expenses, and GST.

Step 3: Review Your Financials Monthly

Don’t wait until the last minute. Reviewing monthly makes BAS preparation easier.

Step 4: Lodge Early (If You Can)

Submitting before the due date reduces stress and gives you time to fix any mistakes.

Step 5: Get Professional Help

Working with a registered BAS agent, such as Perfect Accounting, ensures accuracy, reduces risk, and often provides extended due dates.

Frequently Asked Questions (FAQs)

What happens if I miss a BAS due date?

You may face penalties or interest charges from the ATO. If it’s your first time, you might get a warning.

Can I lodge BAS myself?

Yes, via the ATO Business Portal. But if you’re unsure, it’s better to get professional help.

Is there a benefit to using a BAS agent?

Absolutely. Not only can they lodge for you, but they also help ensure you claim the right deductions and stay compliant.

Why Choose Perfect Accounting?

At Perfect Accounting, we don’t just handle your numbers — we handle your stress. Our agents:

- Are fully registered BAS and tax agents

- Offer affordable, transparent pricing

- Provide timely reminders so you never miss a deadline

- Work with popular tools like Xero, MYOB, and QuickBooks

Most importantly, we’re real people who care about your business success. Whether you’re just starting out or growing fast, we tailor our services to your unique needs.

“Perfect Accounting changed how I view business admin. I can finally sleep knowing my BAS is handled.” — Josh T., online store owner

Final Thoughts

Understanding BAS due dates doesn’t have to be scary. With the right approach — and the right team by your side — it becomes just another part of running a successful business.

Take the stress off your plate. Let Perfect Accounting help you stay compliant, organised, and ahead of the game.

Stay smart. Stay on time. Choose Perfect Accounting.