If you’re living and working in Australia, you’ve probably heard the buzz about the Stage 3 tax cuts. But what do they really mean for your paycheck? And how can you figure out exactly how much more money you’ll keep each payday?

That’s where a Stage 3 tax cuts calculator comes in handy. It’s a simple, free tool that shows you how much tax you’ll save under the new rules, starting July 2024.

Let’s break it down in plain English, using real-life examples and a step-by-step guide so you can feel totally in control of your money.

✅ What Are the Stage 3 Tax Cuts?

The Stage 3 tax cuts are part of a series of changes to the Australian tax system that were first introduced back in 2018. These changes aim to make the tax system flatter and simpler — especially for middle to high-income earners.

In simple terms: you’ll be paying less income tax from 1 July 2024.

The idea is to reduce the marginal tax rates, particularly for people earning between $45,000 and $200,000. You can read the official ATO explanation here.

What Is a Stage 3 Tax Cuts Calculator?

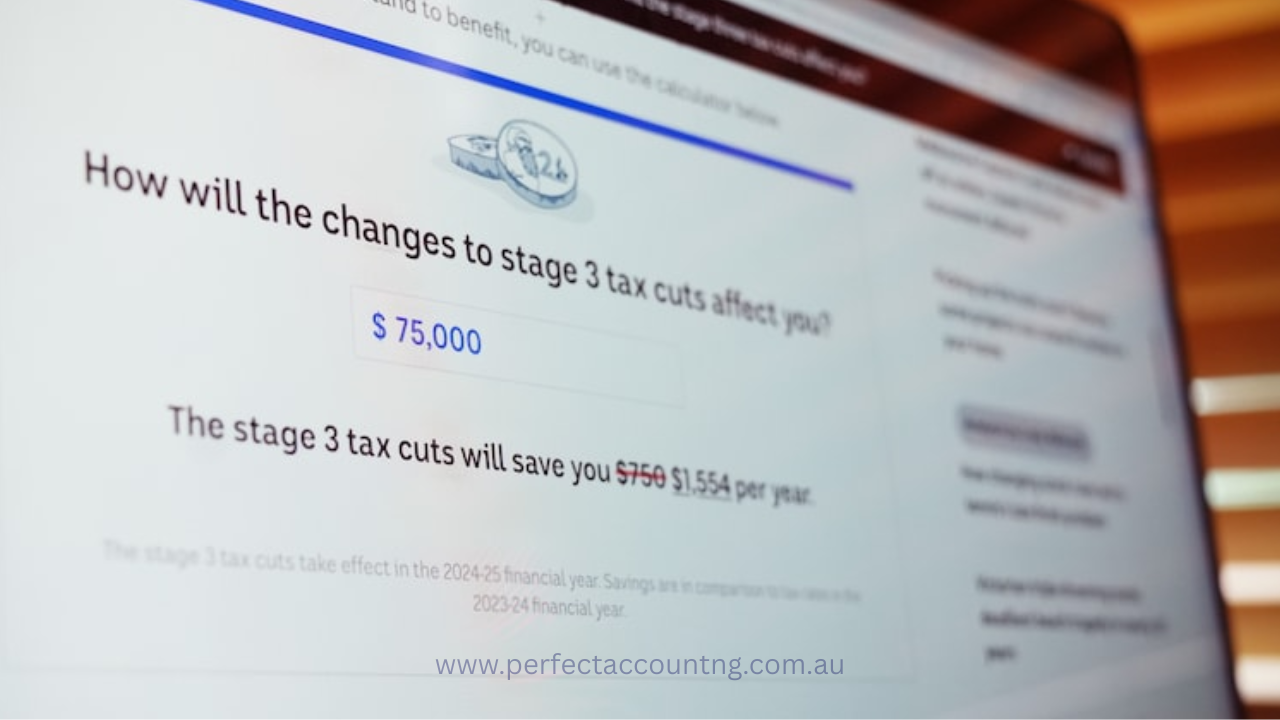

A Stage 3 tax cuts calculator is a free online tool that helps you work out how much money you’ll save after the tax cuts take effect.

It’s super easy to use — you just plug in your annual income, and it calculates the difference between your current tax and the new tax under Stage 3.

Some trusted calculators include:

How Much Will I Save?

Here’s a real-life example.

Sarah, a 35-year-old marketing manager in Sydney, earns $90,000 a year. Under the current tax system, she pays around $20,000 in income tax.

Using a Stage 3 tax cuts calculator, Sarah discovers that from July 2024, she’ll save roughly $1,500 – $1,800 each year — that’s over $30 every week back in her pocket!

Now imagine what you could do with that extra money — pay off your debt, go on holiday, invest, or just breathe a little easier each payday.

Step-by-Step: How to Use a Stage 3 Tax Cuts Calculator

Let’s walk you through it.

Step 1: Find a Reliable Calculator

Go to a trusted source like the ABC’s tax calculator or MoneySmart.

Step 2: Enter Your Income

Type in your gross annual income (before tax and super).

Tip: If you’re not sure of the number, check your latest payslip or log in to your MyGov ATO account.

Step 3: Compare the Results

The calculator will instantly show you:

-

How much tax you pay now

-

How much tax you’ll pay after July 2024

-

The total savings per year/week/month

Step 4: Plan Ahead

Use this knowledge to create a budget plan, pay off credit card debt, or even chat with a tax expert about smart money moves.

Why the Stage 3 Tax Cuts Matter

Let’s be honest — most of us don’t get excited about tax law. But these tax cuts are different because:

-

They affect millions of Aussies

-

They put real money back in your hands

-

They give you more financial freedom

Even better, it’s not just for high-income earners. Many middle-income families will benefit too, especially when paired with smart planning.

A Quick Story from a Local Business Owner

James, who runs a small cleaning business in Brisbane, was skeptical at first. “I thought it wouldn’t really affect someone like me,” he says. “But once I used the Stage 3 tax cuts calculator, I realised I’d save over $2,000 a year.”

He used that money to upgrade his tools and hire an extra part-time worker. “It gave me the push I needed,” he adds.

Stories like James’ show how a small tax break can lead to big opportunities.

Should You Still Talk to an Accountant?

Absolutely. Even with calculators and online tools, tax can still get complicated. And that’s where a trusted expert comes in.

We highly recommend chatting with the friendly team at Perfect Accounting. As experienced Accounting Agents, they specialise in:

-

Tax return reviews

-

Income tax planning

-

Small business financial advice

They’ll not only explain your Stage 3 tax cuts in detail, but also help you maximise your refund and make better financial decisions moving forward.

✅ Visit PerfectAccounting.com.au to book your FREE consultation today!

Final Thoughts: Knowledge = Power (and Savings!)

Using a Stage 3 tax cuts calculator is one of the easiest ways to understand your new take-home pay. In just a few clicks, you’ll know exactly how much you’re saving — and that knowledge gives you power over your money.

Whether you’re planning a trip, saving for a home, or just want to breathe easier with bills, these tax changes can make a real difference.

Don’t wait until the end of the financial year to find out.